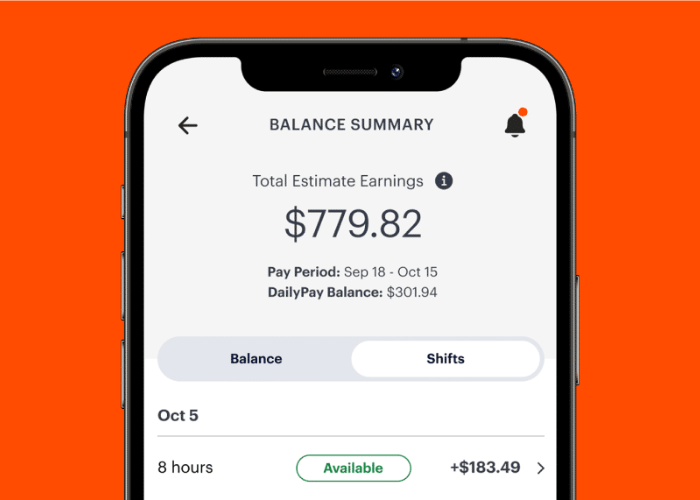

It is a revolutionary development in the world of financial services. It is a payment platform that enables businesses to pay employees on-demand, in real-time, across the globe. This platform is powered by a cutting-edge technology, which enables employers to send payments in a matter of seconds. With this platform, employers can easily manage their payrolls, pay employees quickly and securely, and have better visibility into their employee’s financial health.

Overview of Dailypay

Dailypay is a revolutionary financial technology company that is transforming the way people receive their pay. Founded in 2015, Dailypay has seen tremendous growth over the years, with its most recent funding round of Series D-1 raising $175 million. This brings the total funding to over $325 million and a valuation of $1 billion.

The funding was led by Coatue Management, Ribbit Capital, and Crosslink Capital, and brings on new investors such as Markel Corporation, FTV Capital, and former professional baseball player Carlos Beltran. This impressive line up of investors has made Dailypay one of the most sought after fintech companies in the world. Dailypay is an innovative payment solution that allows employees to receive their wages when they need them, not just on paydays.

This gives people more control over their finances and allows them to take care of unexpected costs or take advantage of potential opportunities without having to wait for their next paycheck. Dailypay is also committed to helping businesses manage their payroll in a cost-effective and efficient manner, giving them the ability to quickly adjust to changing workforce needs.

The funds from the Series D-1 round will be used to support Dailypay’s mission of providing an innovative and comprehensive payment solution for both employers and employees. The funds will also be used to help expand Dailypay’s presence in the United States, as well as to help the company continue to develop new products and services. With these funds, Dailypay is well positioned to continue to revolutionize the way people receive their pay and to become a major player in the fintech world.

Details of the 175M Series D Funding Round

The Dailypay 175M Series D Funding Round is a groundbreaking event for the financial technology company. It was led by Coatue, a private equity firm, and included participation from other investors such as Tiger Global, Thrive Capital, and Dragoneer. The round brings Dailypay’s total funding to $1.325 billion and is the largest round of financing for a fintech company in the US this year. The funding will be used to further expand the company’s reach into new markets and to invest in new product development.

The funds will also be used to accelerate growth by hiring new talent and increasing its marketing efforts. This round of funding is a significant milestone for Dailypay and is a testament to the company’s innovative products and services that are transforming the way people get paid.

Details of the 325M Series D-1 Funding Round

Dailypay’s $175 million Series D-1 funding round was led by Coatue Management, with participation from existing investors T. Rowe Price, Tiger Global, DST Global, Dragoneer Investment Group, and Caffeinated Capital. The round values the company at a staggering $1 billion and is the largest single investment in the history of the fintech industry.

The investment round was the largest single investment in the history of the fintech industry, and will be used to further accelerate Dailypay’s growth and product innovation, as well as to add strategic capabilities and expand its customer base. The funding will also enable the company to continue to build out its infrastructure, allowing it to provide an enhanced service to its customers. The news comes shortly after Dailypay announced its partnership with Beltran, a leading provider of payroll and benefits services.

Through the partnership, Dailypay will provide its customers with a more comprehensive payroll solution, allowing them to access their wages in real-time and manage their finances more efficiently. The new funding round brings Dailypay’s total funding to date to over $250 million, solidifying its position as a leader in the fintech space. The additional funds will help the company expand its reach, hire more talent, and continue to innovate and improve its product offerings.

Details of the 1B Beltran Acquisition

Dailypay, an American financial technology company, recently announced the completion of its Series 325M funding round and its acquisition of 1B Beltran. The strategic move is expected to help the company expand its presence in the fintech industry, as well as provide additional resources to develop and deploy innovative payment solutions.

The acquisition will provide Dailypay with access to 1B Beltran’s experienced team, cutting-edge technology, and robust customer base. The acquisition of 1B Beltran will give Dailypay a substantial competitive advantage in the fintech industry. 1B Beltran’s technology platform, which is powered by artificial intelligence, provides predictive analytics, fraud detection, and automated customer onboarding. This technology will allow Dailypay to make faster, more secure, and better-informed decisions when processing payments.

Additionally, the acquisition will give Dailypay access to 1B Beltran’s customer base, which consists of over 2 million users across the United States and Europe. This will give Dailypay the opportunity to reach a larger audience and create a more diverse customer base. Overall, the acquisition of 1B Beltran is a major milestone for Dailypay. By leveraging 1B Beltran’s technology and customer base, Dailypay will be able to expand its reach and make the payment process more efficient and secure. Additionally, Dailypay’s customers will benefit from the increased data security and faster processing times. Ultimately, the acquisition of 1B Beltran will position Dailypay as a leader in the fintech industry.

Benefits of the Acquisition

The acquisition of Dailypay’s Series 325M and 1B Beltran provides numerous benefits to the company. Firstly, these investments will help Dailypay to increase its market reach and capitalize on new opportunities. Secondly, the acquisition will provide Dailypay with access to the latest technology, including the ability to create a more efficient customer experience.

Thirdly, the investment will help Dailypay to strengthen its financial position, allowing it to better manage risks, and prepare for future growth. Finally, Dailypay will be able to leverage its existing customer base to further increase its customer base and market share. As a result, the acquisition of Dailypay’s Series 325M and 1B Beltran will provide numerous benefits, helping the company to grow and expand in the future.

Conclusion

It is a major milestone for the company and the financial technology industry as a whole. It marks the first time a financial technology startup has raised such a large amount of capital from a single investor. The investment will help Dailypay to further develop its innovative payment solutions and expand its reach across the globe. It will also help the company to further invest in its people, technology, and infrastructure to support its growing customer base. With this new capital, Dailypay is setting itself up for even more success and growth.

Leave a Comment