A simple interest calculator is a useful tool for investors and borrowers. It helps them determine compound interest accumulation and final balances on fixed principal amounts and additional periodic contributions. This helps them reach their investment and savings goals more quickly. It also mitigates wealth erosion risks.

To use this compound interest calculator, enter the initial deposit (principal amount), the interest rate, and the duration/period in years. The calculator will then display the solution and a sample answer for your reference.

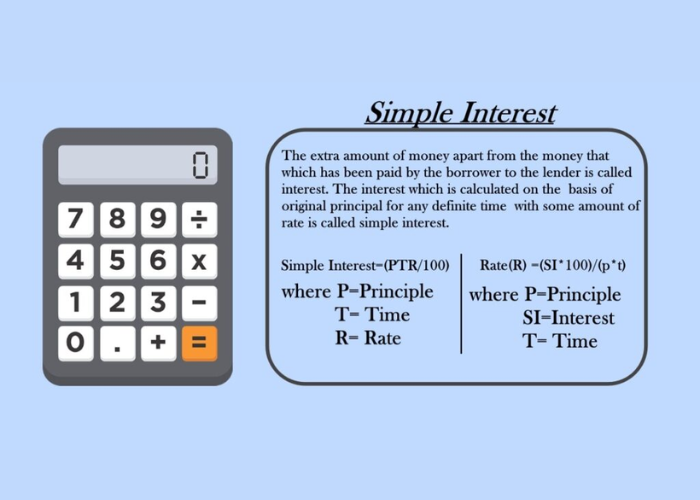

Simple interest

Whether you’re investing or borrowing money, you need to know how much interest you’ll earn or pay. This is important to determine beforehand so that you can plan accordingly and make sound financial decisions. A simple interest calculator helps you calculate this amount easily, allowing you to make better financial decisions that save you money.

To use a simple 이자계산기, you need to enter the initial sum of money (P) that will be invested or borrowed, the annual interest rate (r), and the length of time over which you want to calculate the simple interest. Then, simply multiply these values together. The final result represents the accrued amount, which is the amount you will owe or earn after a given period of time.

The difference between simple and compound interest is that simple interest only applies to the original principal loan amount. Compound interest, on the other hand, takes into account the accumulated interest from previous periods. This can dramatically change the amount of money you’ll end up with after a certain period of time.

The simple interest formula is SI = PRT where P is the initial sum of money, R is the annual interest rate expressed as a decimal, and T is the time period in years. To make the process easier, you can convert percentages to decimals by dividing them by 100 and adding 1 to the result.

Compound interest

Compound interest is a powerful concept that can help your savings or investments grow quickly. To take advantage of compounding, you should invest regularly and hold your money for a long period of time. In addition, you should choose deposit and investment accounts that compound interest. This way, your accumulated earnings will continue to earn additional interest each year. The compounding calculator below will show you how much your investments could grow over time.

To use the calculator, enter your initial investment amount, the annual interest rate and the number of years you plan to invest. You can also select how often you want your accumulated interest to be calculated (either annually, quarterly, monthly or daily). The more frequently you compound, the sooner your accumulated interest will start earning additional interest.

The calculator will then calculate your final investment balance. For example, if you invest $10,000 at a 5% interest rate compounded annually for five years, the final balance will be $10,547. The calculation will also include the impact of your withdrawals and deposits.

Compound interest calculators can be a valuable tool for anyone interested in growing their wealth and financial independence. They can help you determine how much to save or invest, and what kind of debt to avoid. They can even help you set goals and track your progress.

Fixed rate

When shopping for mortgages or auto loans, it’s important to use an online 금융계산기 to understand what your payments will be. These calculators help you determine the actual cost of a loan by comparing flat interest rates with effective interest rates. The differences can be significant over time and are particularly important for large purchases such as cars or homes.

To use a loan calculator, input your loan amount, term and interest rate. Then, press calculate to see your results. Be sure to enter the correct values to avoid an error message. The calculator assumes that the loan is amortized over its term, which means that the payments will include both principal and interest each month. It does not take into account other types of payment structures, such as graduated repayment or income contingent payments.

Fixed interest rates are a great choice for those who want to know exactly how much they’ll have to pay each month. They also provide stability in a volatile financial environment. However, there are some drawbacks to this type of loan. If you’re interested in getting a fixed rate, be sure to shop around for the best deal.

To calculate your interest rate, first convert the annual percentage rate (APR) to a monthly interest rate. Then, divide the monthly rate by the number of months in your loan term. For example, a 6.5 APR would become 0.065 if divided by 12 months. You’ll then need to multiply this number by the loan term to find the total cost of your loan.

Variable rate

Many financial products come with the option of a variable interest rate, including credit cards and student loans. A variable rate is tied to a benchmark index, such as the 1-month LIBOR, and can change on a monthly basis. The change in the variable rate can impact your monthly payment and the overall cost of the loan.

It’s important to weigh the pros and cons of a variable rate before making a decision. A variable rate can help you save money, but it may be riskier than a fixed rate. If the benchmark index you’re tied to goes up, your interest rate will also increase. This could lead to higher monthly payments, which can be difficult for some borrowers to handle.

A good way to determine which type of rate is best for you is to look at market conditions and compare the two options. If you’re considering a variable rate, ask the lender how often the rate changes and whether or not there is a cap.

An interest calculator can help you calculate your APR and see how much of your balance is going to interest each month. You can use this information to help you make wise financial decisions, such as deciding what purchases are worth making with a credit card. An interest calculator can also show you how quickly your credit card balance is growing.

Leave a Comment